Discover the Best Forex Trading Platforms for Your Trading Needs

Good Forex Trading Platforms: A Comprehensive Guide

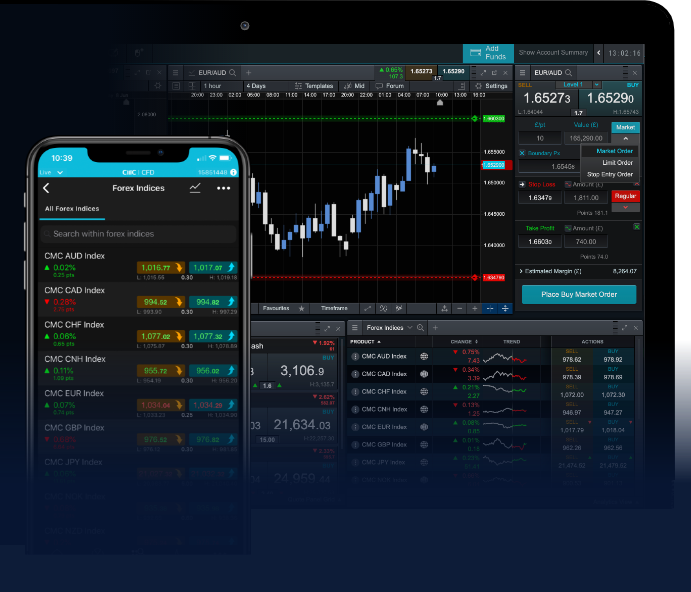

In the rapidly evolving world of forex trading, selecting the right trading platform can significantly impact your trading success. A good forex trading platform combines user-friendly interfaces, advanced tools, robust security measures, and reliable customer support. One example of a solid choice in this space is good forex trading platforms Trading Broker JO, which offers a comprehensive suite of services ideal for both novice and experienced traders. In this article, we will explore what constitutes a good forex trading platform, highlight some of the leading platforms available today, and provide tips on how to choose the best one for your trading needs.

What Makes a Good Forex Trading Platform?

When evaluating forex trading platforms, several key factors come into play that define their quality and suitability for traders:

- User Interface: A clean, intuitive interface is essential for effective navigation and quick access to trading tools.

- Trading Tools and Features: Platforms should provide advanced trading tools, charting capabilities, and technical indicators to assist traders in making informed decisions.

- Reliability: The platform should be robust with minimal downtime, ensuring that traders can execute trades without interruptions.

- Regulation and Security: Safety is paramount. A good trading platform should be regulated by a reputable authority and implement strong security measures to protect users’ data and funds.

- Customer Support: Efficient customer service availability can provide assistance when needed, enhancing the overall trading experience.

- Fees and Spreads: Transparent fee structures, including spreads and commissions, are vital for maintaining profitability in forex trading.

- Account Types: Good platforms should offer various account types to cater to different traders’ needs.

Top Forex Trading Platforms

There are numerous forex trading platforms available, each with its strengths and weaknesses. Here are some of the top-rated platforms that traders often consider:

1. MetaTrader 4 (MT4)

MetaTrader 4 remains one of the most popular trading platforms globally. Its user-friendly interface, extensive analytical tools, and support for automated trading via Expert Advisors (EAs) make it a favorite among retail traders. With a vast community, numerous plugins, and a plethora of educational resources, MT4 is suitable for both beginners and experienced traders.

2. MetaTrader 5 (MT5)

Building on the foundation set by MT4, MetaTrader 5 offers even more advanced features, including improved charting tools, more timeframes, and a built-in economic calendar. It allows trading in various financial instruments, including stocks and commodities, making it a versatile choice for traders looking to diversify their portfolios.

3. cTrader

cTrader has gained popularity for its advanced trading capabilities and intuitive interface. The platform is known for its excellent charting tools, rapid order execution, and support for algorithmic trading. It also offers a unique feature called “cAlgo,” which allows traders to create automated trading systems using C# programming.

4. NinjaTrader

NinjaTrader is a popular platform among day traders and futures traders. It provides comprehensive charting capabilities and advanced trade simulation tools. While NinjaTrader is primarily known for its features in futures trading, it also supports forex trading and is favored by traders looking for in-depth market analytics.

5. TradingView

While not a broker itself, TradingView is a powerful charting platform that allows traders to analyze forex markets through detailed charts and social trading features. Its unique capability of offering a collaborative trading environment allows traders to share ideas, making it an excellent platform for learning and market analysis.

How to Choose the Right Forex Trading Platform

Selecting the best forex trading platform for your needs involves considering several important aspects:

- Identify Your Trading Style: Understanding your own trading style (scalping, day trading, swing trading, etc.) will guide you in choosing a platform that offers the necessary tools and features.

- Research Broker Regulations: Ensure that the broker is regulated by a reputable financial authority, such as the FCA, ASIC, or CySEC. This adds a layer of security and trust to your trading experience.

- Test the Platform: Take advantage of demo accounts offered by many platforms. Testing the software without risking real money can help familiarize you with its features and functionality.

- Evaluate Customer Support: Reach out to customer support with questions before opening an account. Fast and knowledgeable responses can be indicative of the level of service you can expect post-sign-up.

- Assess Fees: Compare the spread, commissions, and overall trading costs between different platforms to find one that fits your budget while meeting your trading requirements.

Final Thoughts

Selecting the right forex trading platform is crucial for your trading success. As the forex market continues to grow, new platforms with innovative features emerge. By understanding what a good platform entails and researching your options, you can find a trading environment suitable for your needs and goals. Always remember to take advantage of demo accounts and do thorough due diligence before committing to a platform. Happy trading!

Leave a Reply